COVID-19 continues to take a serious toll on the UK’s High Streets, with the British Retail Consortium reporting a 36.9% decline in footfall last month. Meanwhile, with social distancing restrictions in place for the foreseeable future, the crisis is driving more traffic to eCommerce merchants and changing consumer habits.

To help brands better understand this dramatic shift in behaviour, we asked 1,005 UK consumers to share how the pandemic is changing the way they shop, as well as if they think these changes will last in the long-term (*see below for the full survey methodology).

How are shoppers responding to social restrictions?

Referred to as “a nation of shopkeepers” by Adam Smith in The Wealth of Nations, today it is probably more accurate to describe the UK as a nation of shoppers. Indeed, UK consumers are some of the biggest retail spenders in the world. But the coronavirus has meant the vast majority have had their consumer habits disrupted in recent months.

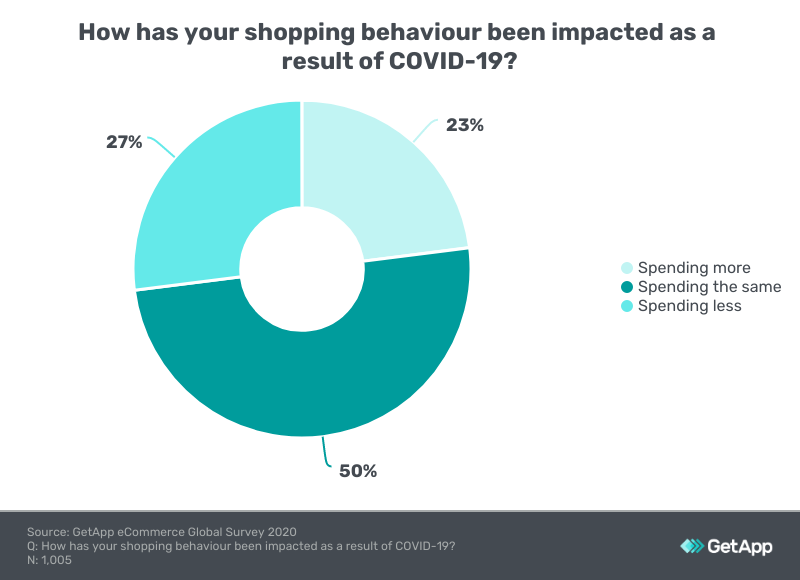

When it comes to overall expenditure across in-store and online, half of us are spending about the same as before the pandemic in retail sales, with 23% spending more and 27% less. Further, 63% expect their spending to remain the same over the next six months.

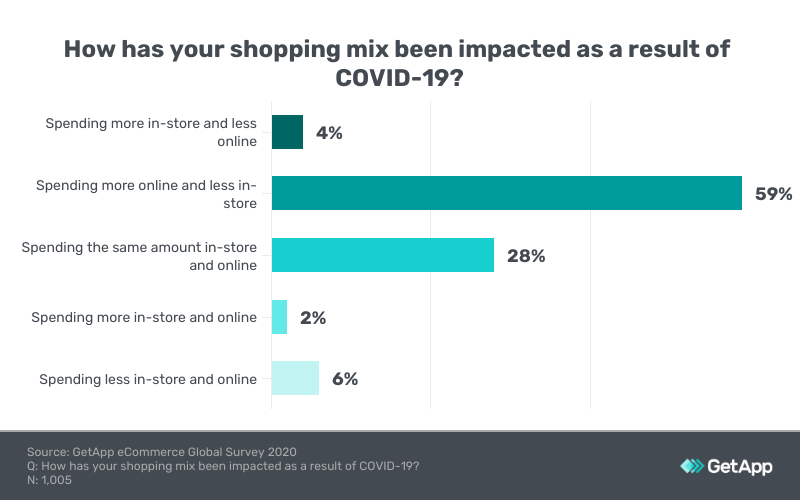

However, looking at where we spend, the shift is more significant. Almost six in 10 people (59%) report spending more online and less in bricks and mortar stores. And it appears this trend is only going to become more pronounced. In the next six months, 48% will continue spending more on online retailers and less in physical stores, while 39% state they will continue to spend the same amount via both channels.

An eCommerce Christmas

The Christmas shopping period, the most important of the year for many retailers, will be particularly impactful, with 52% stating they will spend more online and less in-store.

COVID-19 is a clear factor — 41% said they would prefer this wasn’t the case, as they feel shopping in-store is an important part of getting into the Christmas spirit. Only 28% consider this shift to be a good thing due to the added convenience it provides.

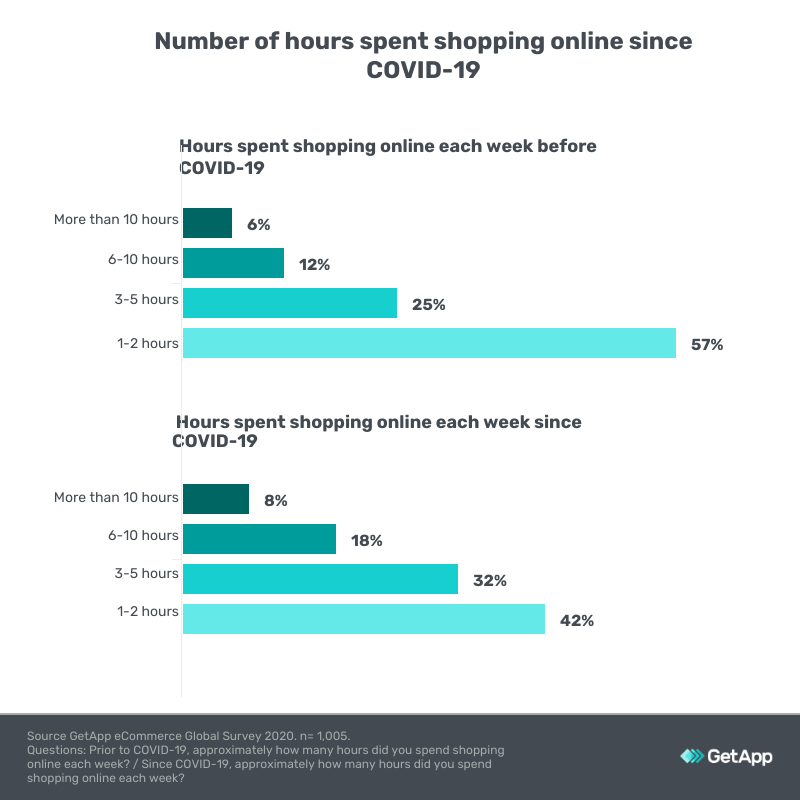

It’s not just our money we’re spending more online—we’re spending more of our time too.

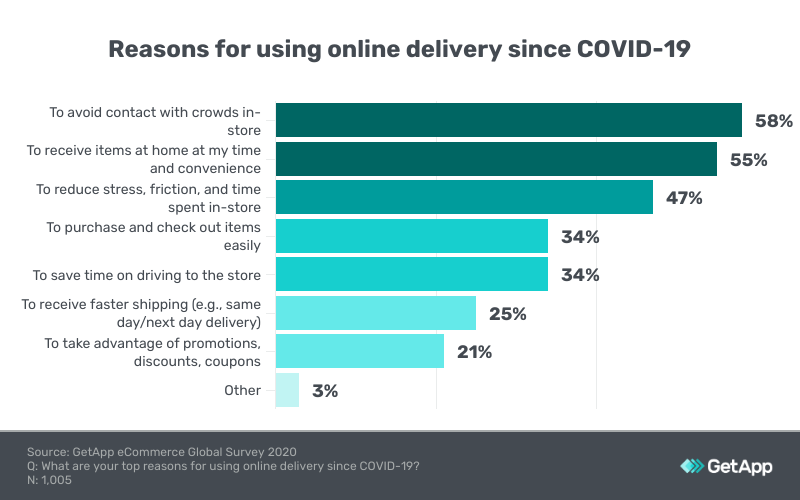

The research reveals that COVID-19 is also converting a significant number of people who pre-pandemic did not use online delivery on a regular basis. Asked how often they used online delivery each week since the outbreak, almost a quarter (24%) reported not using it at all before the pandemic. Since COVID-19, this has been reduced by 5%.

The UK’s preferred eCommerce brands

We wanted to learn which eCommerce brands British shoppers use the most. Respondents were asked where they typically shop online, and almost two thirds (65%) selected Amazon, with other online marketplaces (e.g., eBay, Etsy) trailing in second place with 16%. Only 7% selected “direct from retailer/brand websites” and 6% “independent online stores.”

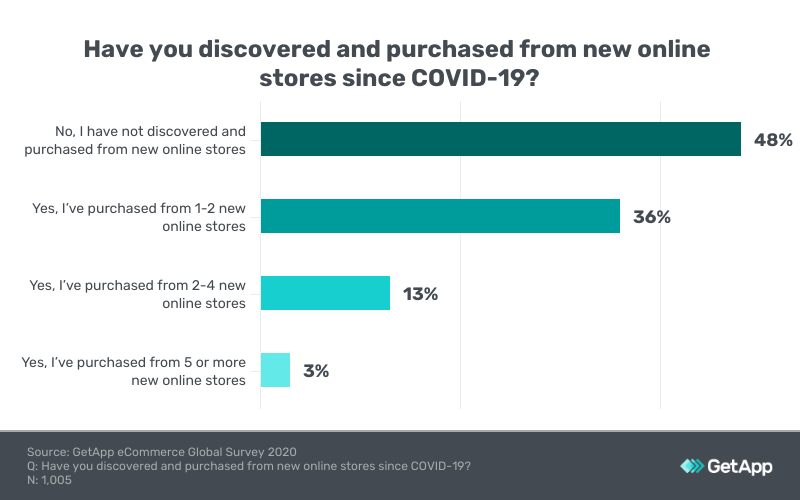

Moreover, most people are sticking to the brands they are familiar with: 48% have not discovered or purchased from any new online stores since the COVID-19 outbreak began. Of those that had, most (36%) had purchased from one or two new outlets.

There is a significant opportunity for eCommerce vendors to grow their business in the current economic environment. However, with relatively few established brands dominating the space, it is vital they understand the trends driving consumer behaviour and consumer habits and adopt a strategy that reflects this.

Driving brand discoverability

Regarding how consumers discover new online shopping sites, search engine optimisation (SEO) ranks by far the most impactful with 32%. Word of mouth referrals come next with 16%, closely followed by website advertisements and social media ads (both on 15%).

Bad experiences while browsing, selecting items or making payments can rapidly result in abandoned baskets which is a longstanding issue for the industry. According to Statista, the worldwide rate for online shopping cart abandonment sat at 69.57% in 2019. Finding effective ways to address it promises to have a significant impact on a merchant’s bottom line.

*Data for the GetApp UK Customer Experience Survey was collected in October 2020 from an online survey of 1,491 respondents that live in the UK.

The survey data used for this article comes from 1,005 participants who qualified to answer. The information in this article corresponds to the average of all surveyed participants.

The criteria for participants is consumers who have made an online purchase in the last 6 – 12 months.