Configure

Configure

About Configure

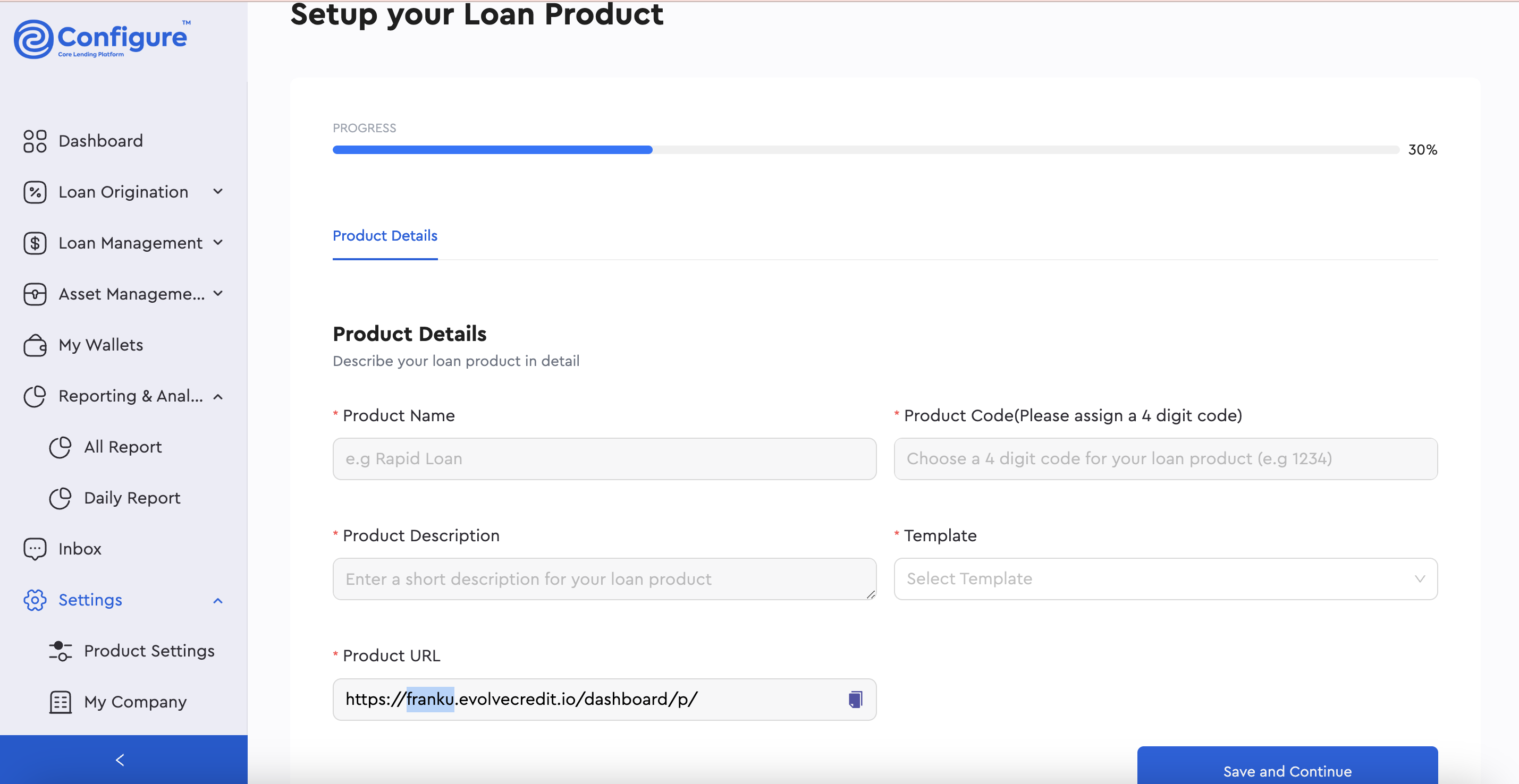

Configure is a flexible and intuitive core lending software that enables organizations to build, launch and scale any kind of loan product. It is suitable for banks, credit unions, digital lenders, alternative credit providers, and community banks. Using Configure, lenders can manage their operations on a central platform, customize the platform to suit their unique needs, and automate simple tasks to increase team efficiency.

Configure enables organizations to automate loan origination, reducing loan processing time. This is possible through web forms that allow people to apply for a loan on any device without visiting the physical location, a secure backend that contains all application details, including functionalities to communicate with the borrower, assign the loan to a team member or drop notes.

It also has advanced communication tools which are automated repayment reminders sent to borrowers and/or guarantors at preset intervals as the repayment date approaches. Configure also supports portfolio growth through an option to create multiple loan products that can be customized to address the needs of the target market.

Other key features are collateral management, audit trail, reports [including custom reports], and amortization schedules.

Key benefits of Configure

Configure simplifies and accelerates the loan origination process by digitizing application submission and document management. This reduces manual effort, minimizes errors, and speeds up loan approval.

Configure enables lenders to provide superb customer experience through a secure and intuitive self-service portal for borrowers, enabling them to apply for loans, track application status, access loan documents, make payments, and manage their accounts conveniently.

It facilitates seamless loan servicing with features like payment processing, escrow management, loan restructuring, collections, and delinquency management. Lenders can effectively manage loan portfolios and gain visibility into their entire operation

Configure provides in-depth reporting and analytics tools to monitor key performance indicators, track loan portfolio performance, identify trends, and make data-driven decisions.

Images

Not sure about Configure?

Compare with a popular alternative

Show more details

Starting Price

Pricing Options

Features

Integrations

Ease of Use

Value for Money

Customer Service

Alternatives

Filter by

Time used

4 Reviews for UK Users

This service may contain translations provided by google. Google disclaims all warranties related to the translations, express or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose and noninfringement. Gartner's use of this provider is for operational purposes and does not constitute an endorsement of its products or services.

- Industry: Financial Services

- Company size: 2–10 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 10.0 /10

Product Reviews

Reviewed on 16/08/2023

Easy capture of repayments and all borrowers data are well captured on Configure. General loan...

Easy capture of repayments and all borrowers data are well captured on Configure. General loan management and administration. With Configure, I can see all cancelled, failed, successful and pending disbursement at a glance amongst others.

Pros

The integration with my existing process was seamless. The team are the best ever! Always available to resolve any issue. They are professional and dynamic.

Cons

Reporting and analytics part of the configure can still be improved upon. I believe the management are top of it as I already discussed with the team.

Response from Evolve Credit

Thank you, Afolabi, your fantastic review warms our hearts. Your feedback means a lot to us, and we truly value it. As we move forward, our dedication to enhancing Configure remains resolute, ensuring your evolving requirements are met in the months ahead.

We are excited to maintain our support for you and your team, just as we have done before, and eagerly anticipate our continued collaboration.

- Industry: Information Technology & Services

- Company size: 51–200 Employees

- Used Daily for 1+ year

-

Review Source

Show more details

Overall rating

- Ease of Use

- Customer Support

- Likelihood to recommend 7.0 /10

Pros & Cons of Configure

Reviewed on 23/08/2023

Pros

Configure enables efficient management of multiple loan products while tailoring the loan application process to align with each product's unique requirements. Additionally, the solution seamlessly supports third-party integrations, facilitating the connection of external solutions to the platform, thereby enhancing the overall lending experience to a world-class standard.

Cons

Opportunities for enhancement include implementing white-labelling capabilities to align the platform with our branding preferences. Additionally, refining the platform's analytics to capture lending metrics would provide valuable insights into our business's performance

Response from Evolve Credit

Thank you for your valuable feedback on Configure, Olayemi. We appreciate your insights.

We're glad you find Configure efficient for managing your loan products.

We're actively considering your suggestions for white-labeling and improved analytics to align better with your needs.

Your input helps us improve.

- Industry: Hospital & Health Care

- Company size: 51–200 Employees

- Used Daily for 1-5 months

-

Review Source

Show more details

Overall rating

- Ease of Use

- Likelihood to recommend 5.0 /10

Helium Health Credit Operations review

Reviewed on 16/08/2023

Pros

It is easy to use and understand

Cons

BVN not connecting to Evolve. Users find hard to receive otp for BVN access.

Response from Evolve Credit

Thank you for the review, Ayisat. Our unwavering dedication to refining Configure stands strong and we're committed to ensuring that we align perfectly with your needs.

Thank you for your support and for being with us every step of the way.

- Industry: Financial Services

- Company size: 2–10 Employees

- Used Daily for 1-5 months

-

Review Source

Show more details

Overall rating

- Value for Money

- Ease of Use

- Customer Support

- Likelihood to recommend 9.0 /10

Configure Review

Reviewed on 23/08/2023

We use Configure as our loan software app to get applications, approve or decline loan applications,...

We use Configure as our loan software app to get applications, approve or decline loan applications, disburse loans as well as collect and track our repayments. Yes, Configure has been beneficial towards achieving our goals.

Pros

The product is easy to use and understand, basically it is user-friendly. It caters to our need as an organization.

Cons

Nothing for now. Configure has been able to cater to our daily customer need.

Response from Evolve Credit

Dear Victoria, we appreciate your review. It brings us joy to learn that Configure has successfully fulfilled your business requirements. We eagerly anticipate an ongoing collaboration with you.

Configure FAQs

Below are some frequently asked questions for Configure.Q. What type of pricing plans does Configure offer?

Configure offers the following pricing plans:

- Starting from: US$1,000.00/month

- Pricing model: Subscription

- Free Trial: Not Available

Q. Who are the typical users of Configure?

Configure has the following typical customers:

Self Employed, 2–10, 11–50, 51–200, 201–500, 501–1,000, 1,001–5,000

Q. What languages does Configure support?

Configure supports the following languages:

English

Q. Does Configure support mobile devices?

Configure supports the following devices:

Q. What other apps does Configure integrate with?

We do not have any information about what integrations Configure has

Q. What level of support does Configure offer?

Configure offers the following support options:

Email/Help Desk, FAQs/Forum, Knowledge Base, Phone Support, Chat

Related categories

See all software categories found for Configure.