This article was originally published on 23/02/2021

A business plan is the first step for any prospective SME. While starting a new company in the 2020s may feel like trying to build a sailing boat in choppy waters, our free business plan template below can help take a lot of pain out of the process.

In this article

Just because the past several years have been tumultuous it doesn’t mean that the world should hunker down to safely ride out the storm. Life goes on, and the path forward includes the emergence of new businesses.

To navigate these rough waters, though, it’s important to have a sound small business plan in place as you start your new venture. In this article, we explain how this works in practice and provide a free UK business plan template for entrepreneurs that will help you get started .

Why do you need a business plan for your startup?

A business plan is an outline that can be used as evidence to secure loans and financial backing from investors. It provides a snapshot of a company’s goals and planned direction.

Beyond just helping you secure funding for your business, a business plan can also help:

- Organise ideas for the business

- Uncover gaps in your plan

- Lay out a clear strategy that can be referred back to

- Track company progress

While a sound business plan is essential for setting a business off on the right foot, there’s a lot more that can be done before starting operations. After introducing our pre-prepared startup business plan template in the section below, we’ll examine six tips for new business owners.

A business plan template for startups

Working out how to create a startup business plan may not seem straightforward at first.

Using a business plan template designed for UK startups allows SME owners and founders to get a clear idea of the data they should present upfront.

The startup business plan template provided below is based on information provided by the British Business Bank to ensure that SME founders and stakeholders can create an effective outline for their new company.

Click the adjacent link to download the full free business plan template for startups.

Next steps for startups

Once the startup business plan template is in place, your new company can be taken a lot more seriously by potential stakeholders. But there is still plenty that can be done before opening your doors to customers.

Follow these tips to keep your project moving in the right direction:

1. Register your business

Do you want to launch as a sole trader, a limited company, or a partnership?

You’ll need to decide which you prefer before you start trading. However, each option has its own advantages and disadvantages.

As a sole trader, you’ll have the most freedom and the simplest setup, but also the most personal accountability and liability if your business loses money. This is a good option if you’ll be personally overseeing all aspects of your business and if you have a fairly low-risk business plan.

As a limited company, you’ll have a layer of protection between your personal finances and your business finances, but you’ll also have more responsibilities as a company director. If you choose this option, it’s highly recommended that you hire a professional accountant.

If you’re setting up a company with a 50/50 partner, you should establish a partnership. This will ensure that all profits, taxes, and debts will be equally divided between you and your business partner.

These are some of the most common types of businesses, but there are additional considerations, such as if you will be selling goods online, importing and/or exporting, collecting personal data, running your business from your home, and hiring help.

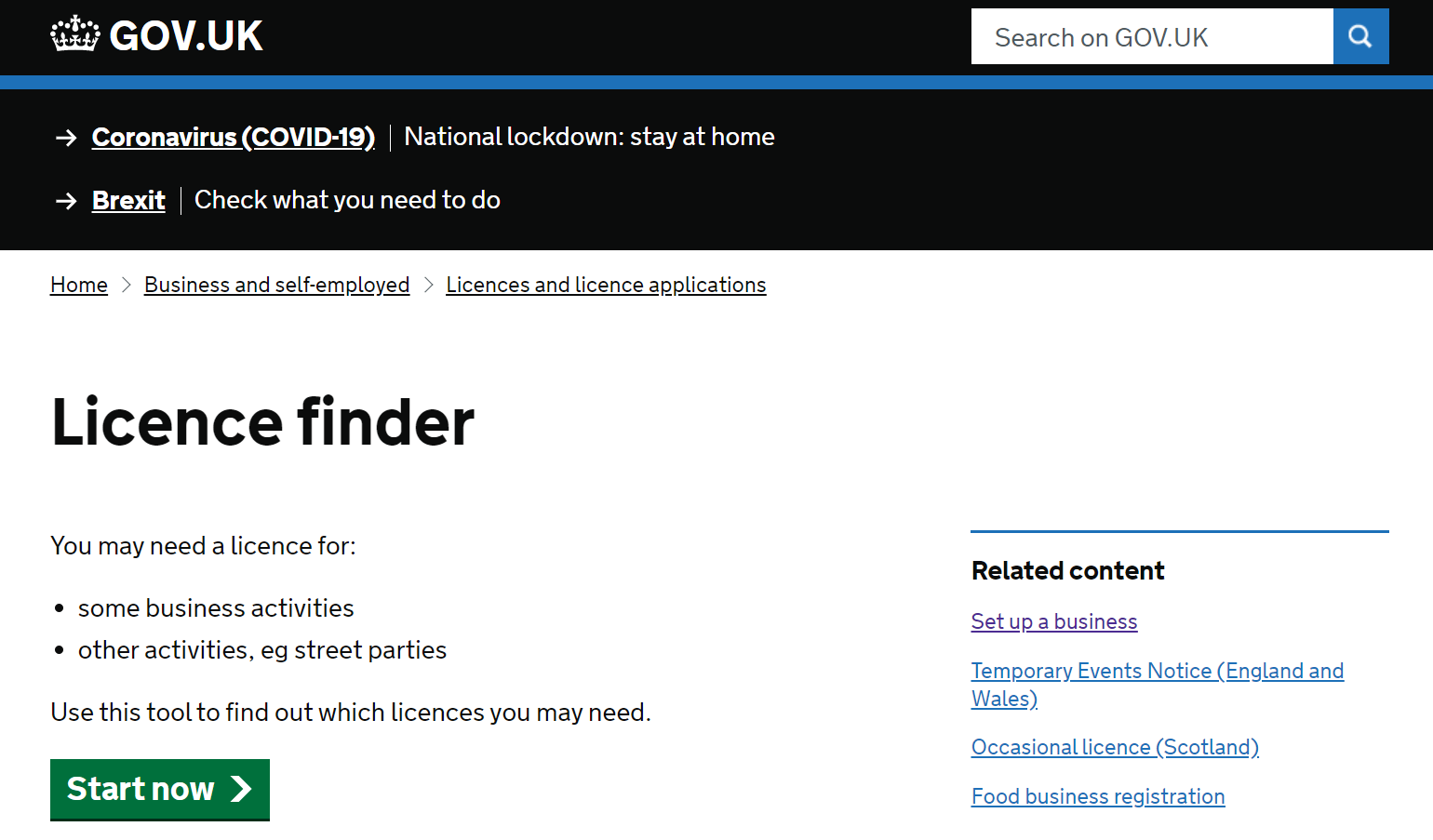

2. Check the rules for your business

Whether you’re opening a pub or a web design agency, there are unique variables for your business. For example, you may need a special licence for the type of business you’re planning to start.

GOV.UK offers a tool that can help founders find out which licences might be needed before opening a shop. It is advised to check this before launching operations to ensure that you are in full compliance with the law.

Additionally, it may be helpful to talk to a lawyer or trusted adviser in that field to get the lay of the land. This allows startup founders to get a clear idea of the specific licences that will be needed for their individual circumstances.

3. Build your financial foundation

Whether you’re launching a sole tradership or a limited company, you need a solid financial foundation or you’ll be facing an uphill struggle before you make your first sale.

If you’ve chosen to start up as a sole trader, it’s especially important to have a solid financial foundation, because if your business ends up owing a lot of money, you’ll personally be responsible for paying back those debts.

As discussed above, limited companies have more financial safeguards. But whether you’re a sole trader or a limited company, you’ll need startup capital to get going.

This money can come from your personal savings, family loans, bank loans, government loans, and other sources.

British Business Bank’s Start-Up Loans program lends up to £25,000 at a fixed rate of 6% per annum for one to five years for qualified businesses. The loan is government-backed and includes one year of free mentoring. A sound business plan is key to loan qualification.

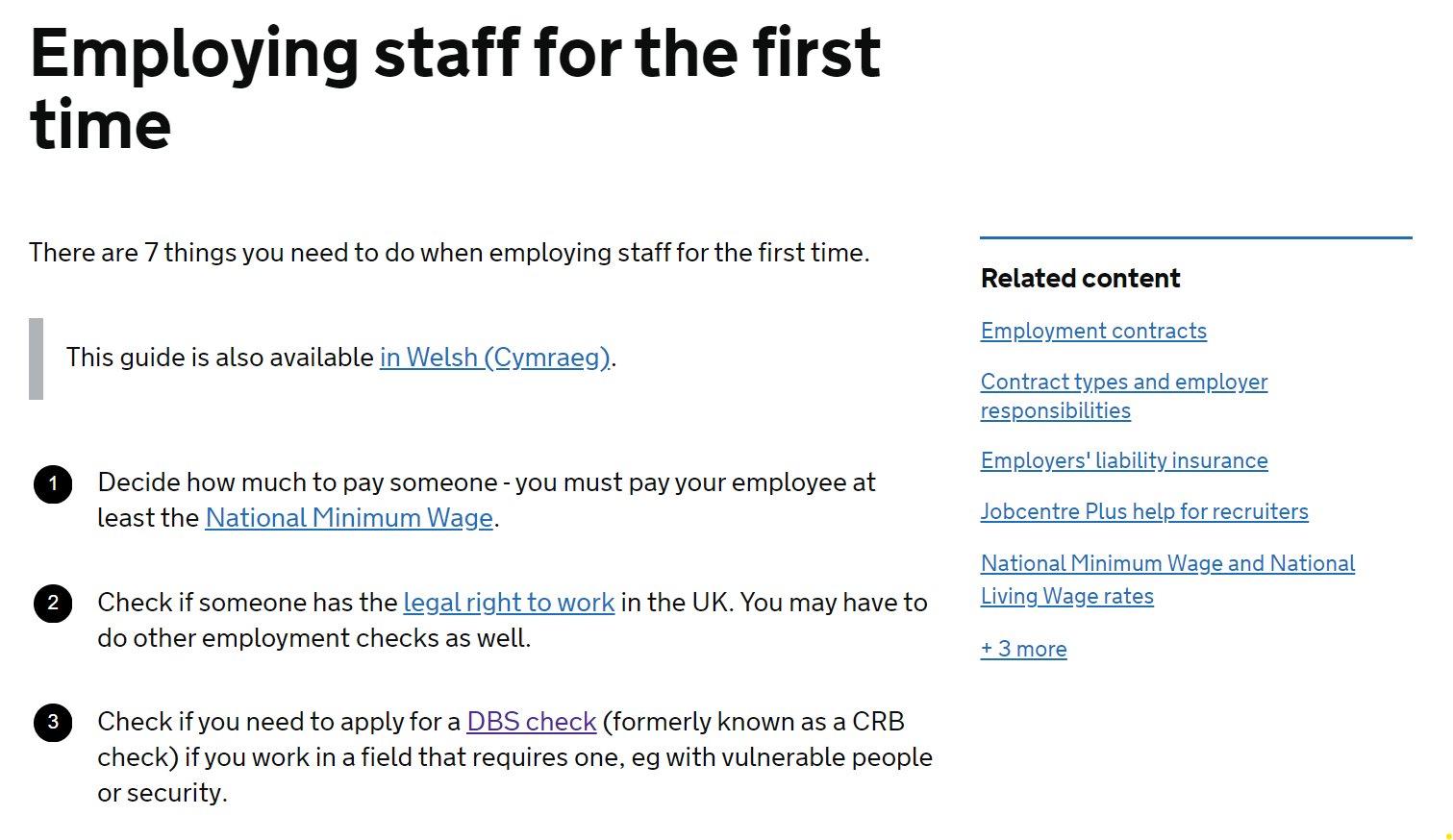

4. Hire the right people

If you’re a sole trader selling your own merchandise, you might not need to bring on any employees. But if you need to hire help —whether it’s seasonal help on a freelance basis or a full-time staff— it’s important to follow the rules, from running payroll to paying for their National Insurance (employers can claim an allowance against these costs in some cases).

GOV.UK offers further guidance on how to hire employees for the first time. Some of the most important considerations include:

- Determining fair wages

- Running employment checks

- Securing employer liability insurance

- Providing a written statement of employment

- Registering as an employer with Her Majesty’s Revenue and Customs

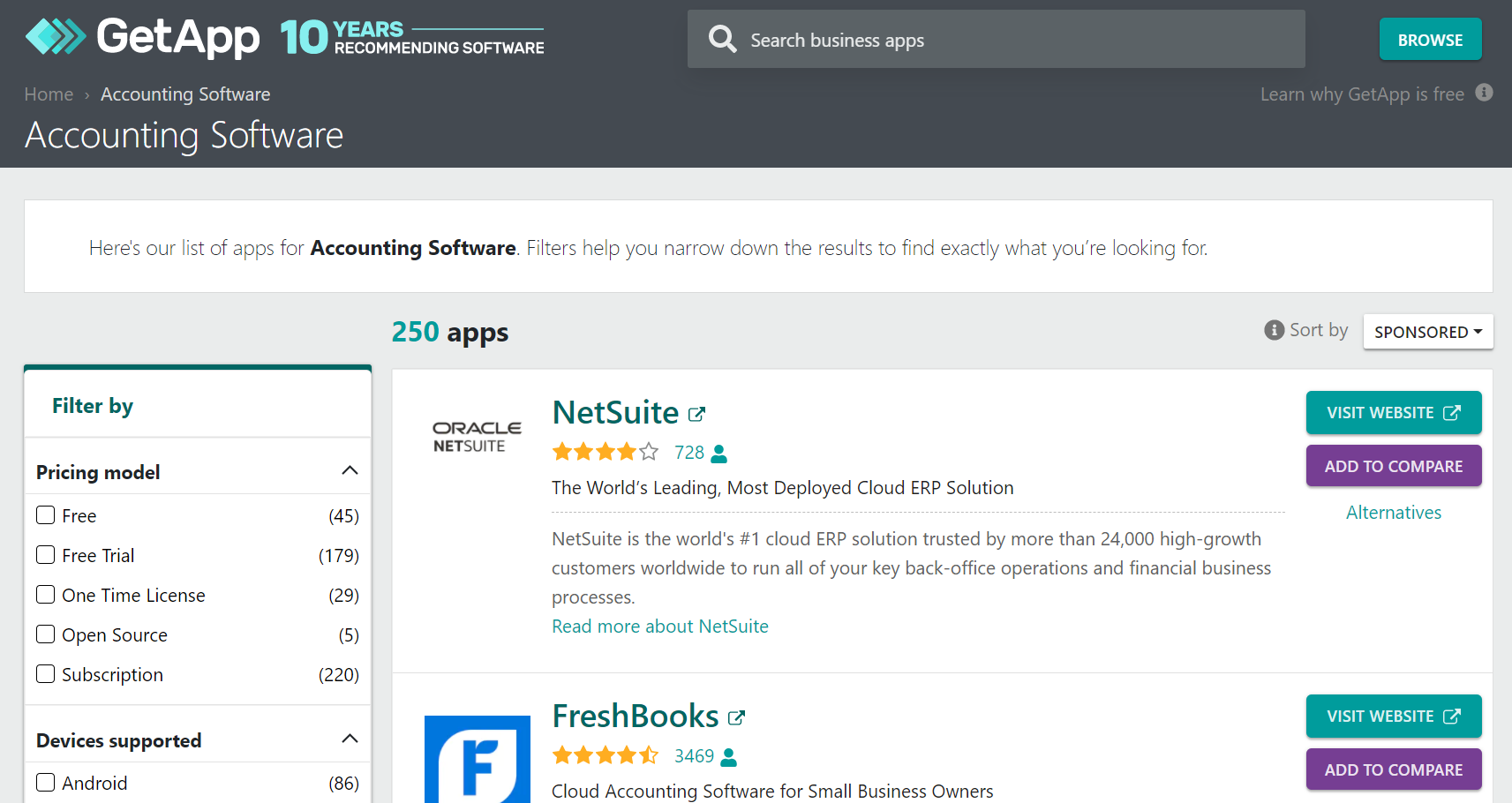

5. Assemble your software stack

Starting a new business requires a lot of work. However, software can save time spent on tasks that could be automated.

When creating a UK business plan template it can help immensely to have the software you want to use clear in your mind. Whether it is accounting software, CRM software or project management software, this will help show potential investors or interested parties that you have done your due diligence.

A lot of software vendors offer cost-free trials or free versions of their platforms. This gives founders the chance to learn what best fits their requirements. Users of our reviews platform can find these options quicker by using the filtering options to compare software offered on a free trial or freemium basis.

6. Market your new business

No matter how solid your startup business plan template is, it’s essential to market a business properly in order to accelerate growth. This can be made easier with a number of specific software tools.

More than 20% of the business owners we surveyed in GetApp’s New Business Model Survey 2020 said they needed new marketing software to support their new business model, just behind video conferencing, CRM, and live chat software.